Good afternoon!

I would like to thank the Executive Team for giving me this opportunity to speak on the historic 1st KWS-H Youth Day celebration.

Many of you would have also noticed and at one time or another wondered as to why most wealthy families or households, particularly in our community, have not been able to preserve and build-on the wealth that was created / built-up in a previous generation. I myself have been a part of many casual evening chats which ended up delving into this very same topic.

My curiosity was partly answered but also got mostly enhanced after I started a career in the private equity industry which provided me a closer glimpse of how the ultra-rich preserve and invest to grow their wealth – to last through many generations. Hence, it lead me on to a path of exploring the various investment models / structures, tax planning, etc adopted by the rich to preserve and grow their wealth, gulping down any possible material available on the internet and several books on personal finance, wealth management, investments, etc in the process.

Hence, on a similar occasion about 2 years back, I took the opportunity to explore a biblical perspective on ‘wealth creation and sustenance’. Drawing from the ‘Parable of the Talents’, the attempt was to understand if our inability to build-on and preserve wealth stems from the way it is generated in the first place (probably not on biblical principles) and/or our failure to thereafter use and multiply it based on biblical principles – like the servant who was entrusted with ‘one talent’ by his master.

I did highlight at that time that there is a financial perspective to the topic/issue. Therefore, when I was asked to speak on Finance on this occasion, I thought it might be a good opportunity to explore the non-biblical or financial aspects of preserving and building wealth, across generations – particularly, why it is something that continues to elude our community.

Fully aware that this could end up being an abstruse, humdrum talk on finance, I will not delve too much into the financial concepts but rather focus our discussion today on the practical aspects of a few key financial concepts – which we shall briefly introduce.

I do hope the deliberations that follow would help everyone appreciate (including those who purportedly hate anything to do with finance or numbers), how a keen understanding of these simple and basic principles could be what separates those who get to become rich from the poor and those who are able to preserve / grow wealth across generations from those who continue to fail to do so.

That probably also explains the topic / title I have chosen for our discussion today – Financial Intelligence!

GUESSTIMATES

To put things to a broader perspective, let’s start by attempting the following guesstimate questions:

(Guesstimates are a favourite interview question for MBA jobs and involve trying to estimate a value or number – for which there is possibly no one correct answer. The key to attempting these questions is the logical steps through which one arrives at one’s chosen value or number)

- How much of the world’s wealth is owned by 1% of the richest population?

- How much of the world’s wealth is owned by the poorest 50% of the population?

- What would happen if the total world’s wealth is re-distributed equally to everyone?

- What are your odds of becoming a Millionaire?

- For how many generations would the world’s richest population be able to preserve their wealth?

Accordingly to a Credit Suisse report last year, 1% of the richest population owns more than half of the world’s wealth. In sharp contrast, the bottom half collectively owns less than 1% of the total wealth.

If capitalists be damned and the total wealth were to be re-distributed equally to everyone, most social scientists predict that it would only be a few years before wealth distribution inequality returns to the above highly-skewed profile.

There is some interesting research and books like ‘The Millionaire Next Door’ which have attempted to profile millionaires and compile their common characteristics. There are reports which have even gone on to the extent of trying to predict the probability of becoming a millionaire based on one’s race, education, etc.

And when it comes to preserving wealth, multiple studies suggest that 70% of wealthy families see their fortune dissipated by the third generation and 90% by the fourth. Then again, there are outliers like the Rothschild Family who have been able to preserve their vast fortune for over 200 years.

Hence, the above guesstimates seem to suggest that there is a science or an art to building and preserving wealth. And if such an art or science is learnt, there could be a possibility of not only enhancing one’s chance of becoming a millionaire but also be in a better position to preserve it much longer.

And the comforting prospect is that, if you have the patience to sift through the seemingly complicated financial concepts, investment models and structures, what lies at the core of imbibing such an art or science is this – just 5 basic financial terms and ofcourse a keen understanding of the intricate interplay between them.

We shall now introduce these key principles or terms in the next section!

THE BASIC FINANCIAL TERMS

Attempts to improve financial reporting and corporate governance in the thousand years’ old history of private enterprise has led to a fairly standard and widely accepted financial reporting system – which is applicable equally to personal finance as well!

Hence, the financial health of any company today (no matter how big or small) or even that an individual, can be effectively captured using the following 5 basic financial terms:

- Income

- Expenses

- Assets

- Liabilities

- Last, but definitely not the least – ‘Cash Flows’

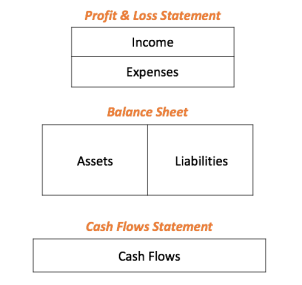

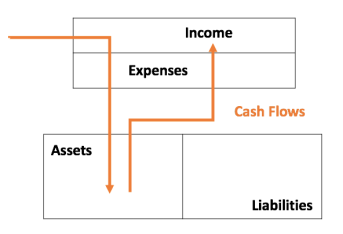

These 5 financial terms form the key heads / components of what is collectively known as financial statements– which typically includes the profit & loss statement which captures income and expenses, the balance sheet which reports the assets and liabilities and the cash flows statement which captures the cashflow activities. A highly simplified tabular representation of the financial statements is as below –

The 5 terms look rather familiar and self-explanatory, even for someone with a non-finance background.

Nevertheless, we’ll just take a quick deeper dive into two of the 5 terms – viz. ‘income’ and ‘assets’ as it would be crucial for us to better appreciate the interplay between them (and will be our focus in the next section).

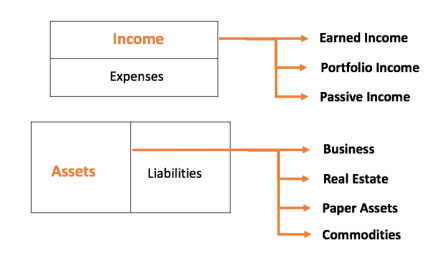

In the current financial world, income can be broadly classified into 3 categories –

- Active Income – also referred to as earned income, where ‘you have to work for your money’ (e.g. salary, commissions, etc)

- Portfolio Income – this is income from investments in stocks, bonds, etc which is better than active income, but ‘involves investment risk’ (e.g. interest, dividends, capital gains, etc)

- Passive Income – also known as cashflow income is the best kind of income, where ‘your money works for you’ (e.g. rent, royalties, etc)

There are different ways in which assets have been classified for the purposes of accounting or otherwise. However, from the perspective of investments or wealth building, we will classify them into 4 broad types, as below:

- Business – owning or investing in companies which generates passive income

- Real Estate – (passive) income generating properties (residential, commercial, retail, hospitality, etc)

- Paper Assets – stocks, bonds, mutual funds, insurance, etc generating portfolio income

- Commodities – gold, silver, oil, platinum, etc generating either portfolio or passive income

Well, you may go ahead and breathe a sigh of relief – coz, that’s all we will need to take on as far as the financial concepts or terms are concerned. But, no big deal right! – just 5 basic, rather familiar and self-explanatory financial terms and a little further break down of income and assets.

We can now move on to the most important and also hopefully, the interesting part of the discussion today – i.e. the interplay between these financial concepts / terms from a real-life’s perspective of wealth building and preservation.

THE INTER-PLAY OR CASH FLOW PATTERNS

An expression which is often used in analysing businesses and investment portfolios is “Cash is King” – rightly so, because financial history is replete with many profitable businesses which have gone kaput due to lack of cash.

Hence, we will use one of the 5 key financial terms – ‘cashflows’ to try and understand the interplay between them. For better clarity and appreciation, we will consider the cash flow pattern for 3 broad financial conditions or status. These 3 scenarios may also be viewed as the 3 stages / steps to achieving personal financial independence or freedom.

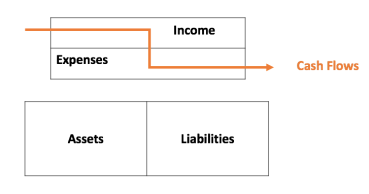

Stage 1: Poor, Jobless or Early Career (Expenses)

The first pattern typically represents the cashflows of the poor (whose condition is often referred to as ‘living from hand to mouth’) but can also be representative of someone who has just landed a job or those in their early career.

As can be seen from the diagram, the cashflows in this scenario or at this stage concerns just income and expenses (i.e. the profit & loss statement). Whatever income is earned or received is fully spent to meet the daily or monthly expenses. Hence, the saying – ‘the poor only have expenses’. This cashflows pattern doesn’t involve or impact the assets and liabilities (balance sheet) of the individual.

I am sure many of us here, who have recently started working or are just a few years into a new job, can relate to this. I can also still remember the early days of my working career when the key concern always was the next increment or raise in order to meet the growing expenses or financial responsibilities of transitioning from being a student to an employed.

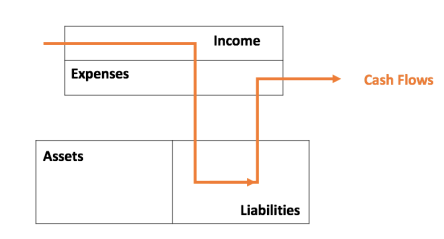

Stage 2: Middle Class (Liabilities)

The second pattern is typical of the middle-class who in an attempt to continuously upgrade lifestyle ends up acquiring more and more liabilities with every increase in pay or bonuses (often mistaking them for ‘assets’). Hence, the saying – ‘the middle-class has liabilities’.

As can be seen from the diagram above, the cashflows, therefore, starts impacting the liabilities side of the balance sheet – i.e. the extra income (over and above the regular monthly expenses) is now being used to generate liabilities (car loans, home loans, personal loans, credit cards, etc). These new liabilities then keeps piling on to the expenses – in form of EMIs, maintenance, insurance costs, interest payments, etc.

Again, I am sure many of us here, particularly those who are already several years into a working career can relate to this. If so, many of us would also be already aware of the risk of over-indulgence and incessant loading of liabilities – which can easily lead one into the typical middle-class debt trap.

Hence, a critical aspect of financial intelligence is to know and appreciate the difference between ‘assets’ and ‘liabilities’ which is succinctly put by Robert Kiyosaki in his top selling book ‘Rich Dad, Poor Dad’ as – an asset puts money in your pocket; a liability takes money out of your pocket.

For example, the brand new car you just bought is a liability and not an asset – as it takes money out of your pocket for fuel, maintenance, repairs, insurance, etc (unless ofcourse you give it to a car renting company like Ola or Uber and are able to earn excess income – in which case, it is an asset as it would put money into your pocket). Similarly, your house, although for accounting purposes maybe considered an asset, is actually a liability as it takes money out of your pocket in the form of the monthly EMIs (unless ofcourse you buy a house or commercial space for renting and are able to earn extra income).

This critical understanding is what separates the rich from the middle class or the poor, who acquire assets (not liabilities), as we shall see in the next cashflows pattern below.

Stage 3: The Rich (Assets)

The above pattern represents the cash flows of the rich – who as highlighted earlier, uses their surplus income to acquire assets. Over time, the assets column generates enough income to cover the regular expenses. The excess income can then be continuously reinvested into more assets, generating even more income. Hence, the saying – ‘the rich get richer!’

If you manage to reach this stage and achieve the above virtuous cycle, you don’t even have to worry about money or losing your job – because unlike the poor or the middle-class, whose cashflow pattern requires them to work for money, the rich can manage their cash flow pattern to have their money work for them.

CONCLUSION

From the discussion today, it becomes evident that if there is one thing that differentiates the poor, the middle-class or the rich, it is how they handle or manage their cashflows – i.e. the financial intelligence to realise that it’s not really about how much money you make.

You must have heard of many successful footballers, who earn in a year what many people earn in a lifetime, suddenly go broke. Apparently, 3 out of every 5 Premier League footballers declare bankruptcy few years into retirement. There are also innumerable stories of people who suddenly get rich after winning a fortune or lottery, but then quickly lose everything and go back to being poor.

What is more important, therefore, is how much you get to keep and how many generations you can keep. A keen understanding of the cashflow patterns we discussed today, is probably the single best explanation as to why a only few manage to become rich and why even the fewer wealthy, particularly in our community, fail to build-on and preserve wealth across generations.

The inability to maintain the virtuous cycle of acquiring additional assets to continuously generate more income or atleast retain the same level of assets (the rich’s cashflow pattern) due to inordinate building up of expenses and/or liabilities result in a fast dwindling of wealth. In most cases and particularly in our community, this typically starts happening right at end of the first generation of initial wealth creation itself – which probably explains why wealth built-up most often don’t last for even another generation.

After the long deliberation today on money or wealth, I would however like to conclude by saying that – ‘it’s not always about the money, honey!’. Perhaps, you must have heard the story of a Harvard MBA graduate and the simple Mexican fisherman. The ebullient MBA graduate was hell bent on convincing the fisherman to grow his small fishing operation into an enterprise so that he could make millions and one day avail the freedom to pursue life’s simple joys. But, it turns out that such a freedom was something his current low-stress, flexible work schedule have already made it possible.

The key, therefore, is to strike the right balance which best suits one’s personal goals and aspirations. Hence, I will sign off here, leaving you with a rather side-splitting thought below.

Thank you all once again!

Ahoi e.👍👍uhaopu

LikeLiked by 1 person

Thankew 🙂

LikeLike

The Rich get richer… Really true, i appreciate your view and writing

LikeLiked by 1 person

Thank you so much for your kind words 🙂

LikeLike

Beautifully written. An eye opener article.. Thank you UFrancis..

LikeLiked by 1 person

hehe..thanks Gou…means a lot..coming from you 🙂

LikeLike

Very impressive..

LikeLiked by 1 person

Thankew 🙂

LikeLike

i learned something on financial intelligence..

this was worth a presentation..

thankyou

Bro Francis Haokip

LikeLiked by 1 person

Thanks a lot Bert…really glad and excited to hear that 🙂

LikeLike

Sir, succinctly explained and easy to understand.

Thank you.

LikeLiked by 1 person

Thanks so much Alex 🙂

LikeLike